Introduction

The digital world is constantly evolving, and at the forefront of this evolution are Non-Fungible Tokens (NFTs). NFTs have transformed how we perceive ownership and value in the digital realm, creating unprecedented opportunities and challenges. As we look toward 2024, let’s explore the landscape of NFTs, their origins, their current state and their future.

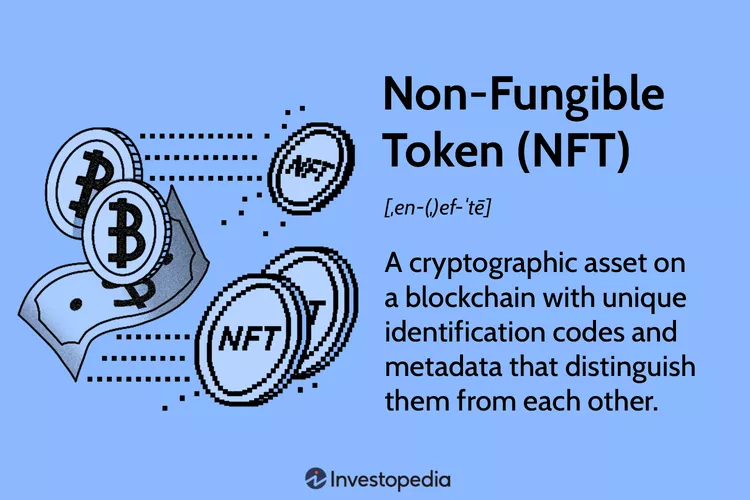

What are NFTs: definition

At its core, an NFT is a digital asset that represents real-world objects like art, music, in-game items, and videos. They are bought and sold online and they are generally encoded with the same underlying software as many cryptos. Unlike cryptocurrencies, which are fungible and can be exchanged like-for-like, NFTs are unique, or “non-fungible,” providing a digital certificate of ownership that can be verified and traced back to the original creator.

What were NFTs originally for

NFTs were originally conceived as a means to authenticate ownership of digital assets in a way that was previously impossible. The first known NFT, Quantum, created by Kevin McCoy in 2014, was a digital image with a blockchain-based proof of ownership. Since then, the scope of NFTs has expanded significantly, encompassing a wide range of digital and real-world assets, fundamentally changing the way artists, creators, and collectors interact with unique digital items.

What makes NFTs unique

The uniqueness of an NFT lies in its ability to verify and validate ownership and the originality of digital assets through blockchain technology. This uniqueness creates scarcity and adds value to digital items that were previously easy to duplicate and distribute without authorization. NFTs have a unique identifier that cannot be replicated, making them distinct from any other NFT and providing a level of security and authenticity previously unattainable for digital assets.

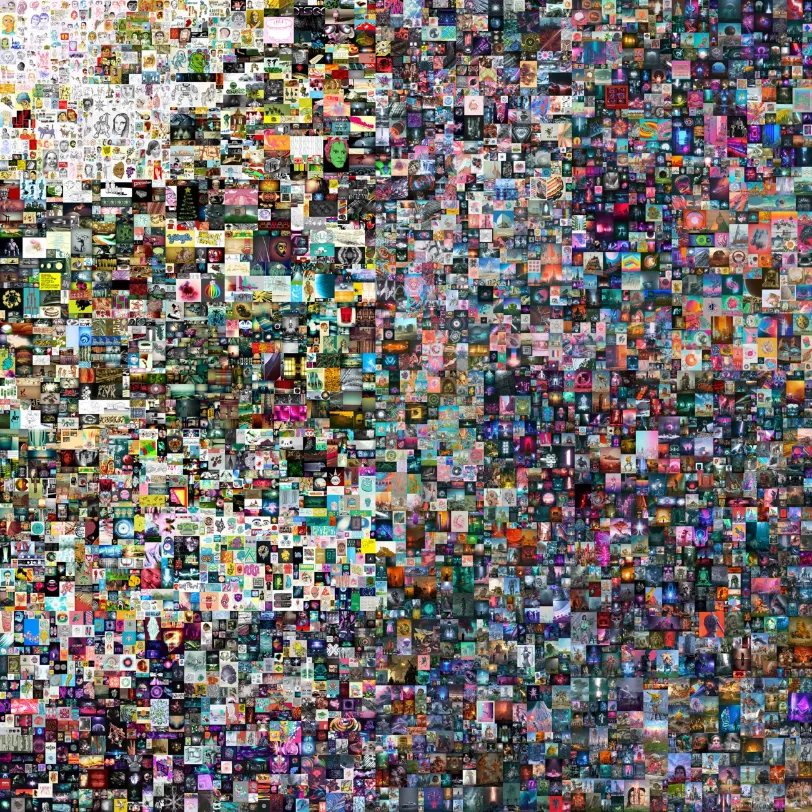

What are the most expensive NFTs

The world of NFTs has seen some staggering sales, highlighting the immense value that can be attributed to digital assets. From Beeple’s “Everydays: The First 5000 Days”, which sold for $69 million, to the first tweet by Twitter founder Jack Dorsey, which fetched $2.9 million, the list of expensive NFTs continues to grow, showcasing the potential for digital creators to earn significantly from their work.

What NFTs are still valuable

Valuing the digital collectibles depends on factors like creator reputation, uniqueness, and history. Early market entries like CryptoPunks and Bored Ape Yacht Club keep their value with strong community ties. These collections set the standard for digital collectibles and community engagement. In 2024, the value of NFTs will likely continue to evolve, with innovation and community engagement playing key roles.

High-Profile Investors

The influence of high-profile investors and celebrities on the perceived value of these NFTs cannot be understated. For instance, the Bored Ape Yacht Club has seen an influx of celebrity members such as Eminem, Jimmy Fallon, Stephen Curry, Post Malone, and Madonna, whose involvement has not only brought significant media attention to the collection but also solidified its status as a cultural and social symbol in the entertainment and sports industries.

Moreover, the landmark acquisition of CryptoPunks and Meebits by Yuga Labs, the creator of Bored Ape Yacht Club, signifies a big moment in the market, potentially reshaping the landscape of the collectibles. This consolidation under Yuga Labs’ stewardship may enhance the value proposition by expanding their utility, community engagement, and integration into broader entertainment and cultural narratives.

Celebrities and influencers

The celebrity endorsement effect extends beyond mere ownership; it creates a virtuous cycle of visibility, desirability, and increased valuation. When celebrities like Stephen Curry or Snoop Dogg share their NFTs, they highlight their investment’s value and prestige. This visibility can boost demand, elevate prices, and energize the secondary market. It solidifies the collection’s standing and fuels the ecosystem’s expansion.

Artistic innovation, community engagement, and celebrity endorsements will likely drive NFT values in 2024. These elements could significantly shape the NFT market’s growth and sustainability. Together, they form a powerful combination for the sector’s future.

What NFTs are still worth money

Certain assets continue to hold significant value. Beyond the high-profile collections, NFTs that offer utility, such as access to events, additional content, or exclusive experiences, are proving to be valuable. The ongoing worth of an NFT often depends on its ability to offer something beyond mere ownership, engaging buyers in a more profound, ongoing relationship with the asset.

What are NFTs in sports

The sports industry has fully embraced NFTs, creating a new realm of fan engagement and memorabilia. Sorare has emerged as a pioneer in this space, leveraging NFTs to revolutionize fantasy sports. With licenses from major baseball, football, and basketball leagues, Sorare allows fans to collect, trade, and compete with digital cards of their favorite athletes. These NFTs offer a unique blend of sports fandom and collectables, providing real-world value by affecting gameplay in fantasy sports competitions.

NFTs in Baseball

In baseball, collectible cards have redefined fan interaction, offering fantasy cards tied to live performances.

Baseball and digital collectibles fans can buy unique tiers of cards with Ethereum or cash.

NFTs in Football

Football enthusiasts on Sorare actively trade and collect their favorite players cards, influenced by real-world performances. Multiple card levels enhance collecting depth. I invite you to find out more about blockchain fantasy football.

NFTs in Basketball

Basketball on Sorare merges fantasy sports excitement with NFT collection, allowing fans digital ownership of game pieces. Fans can invest in different card tiers, reflecting player achievements.

You can sign up using my Sorare affiliate link. Complete the first steps and we both get a free NFT.

High-Profile investors in sports NFTs

Sorare raised $680 million in a Series B round led by SoftBank, valuing the company at $4.3 billion. This round included participation from high-profile investors such as Gerard Piqué, Rio Ferdinand, Antoine Griezmann, César Azpilicueta. Other investors in this round included LionTree, Bessemer Ventures, IVP, Atomico, and D1 Capital, among others. Source

The Panini NFTs

Panini, a leader in sports and entertainment collectibles, has entered the NFT space by offering digital trading cards as NFTs. These cards feature athletes from basketball, football, and soccer, providing collectors with a new way to engage with their hobby. Panini combines the traditional joy of collecting cards with the benefits of digital ownership and the potential for value appreciation.

What are the problems with NFTs

NFTs face several challenges, including environmental concerns (energy consumption) of blockchain networks, copyright and intellectual property rights issues. Potential market saturation and speculation is also a visible issue these days. As the industry matures, addressing these problems will be crucial for the sustainable growth and acceptance of the tokens.

Conclusion

As we look toward the NFT landscape of 2024, it’s clear that NFTs are more than a passing trend. They represent a significant shift in the digital economy, offering new opportunities for creators, collectors, and investors. However, navigating this evolving landscape will require awareness of the challenges and a commitment to innovation and ethical practices.

The future of NFTs is bright, but it will be shaped by the actions of those who participate in the market today.